I’ve seen a lot of discourse since Trump announced his tariff policies. People are debating how this will affect industry in the U.S. and around the world.

I wanted to offer my personal account of how this will literally play out in my business to help some people grasp an otherwise nebulous concept, and offer my perspective as a small, emerging brand.

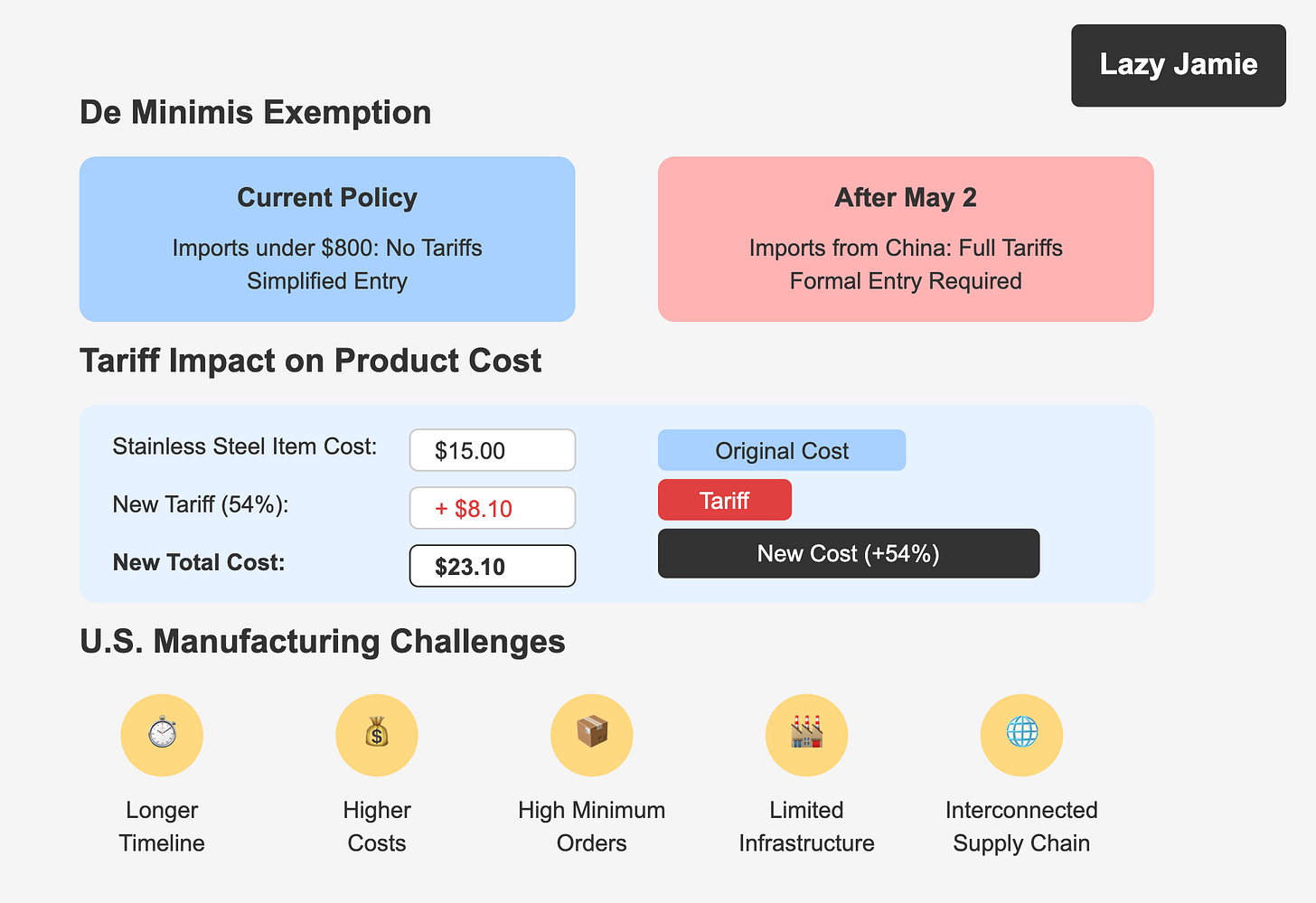

1. What is the de minimis and why does it matter?

I started my home decor business, lazy jamie, by sourcing stainless steel pieces overseas, mostly from China. As we grew, I started to commission pieces, like our spiral flatware and cheese knives. These items are handmade in India, but shipped by a manufacturer in Shanghai.

Up until now, I've used the "de minimis" exemption to import shipments valued under $800 without incurring additional duties when they arrive at U.S. customs. This exemption is a legal provision that waives standard customs procedures and tariffs on items worth less than $800 shipped from foreign countries.

However, Trump has signed an executive order eliminating duty-free de minimis treatment for low-value imports from China and Hong Kong, effective May 2. This makes it much harder for small businesses like mine to import goods affordably.

It's worth noting that the de minimis exemption doesn't typically benefit larger companies because at a certain point, it's no longer efficient for inventory planning to import shipments small enough to stay under the $800 limit.

2. What tariffs will my business actually pay?

After May 2, imported goods from China valued at or under $800 that would otherwise qualify for the de minimis exemption will be subject to all applicable duties and will require formal entry procedures.

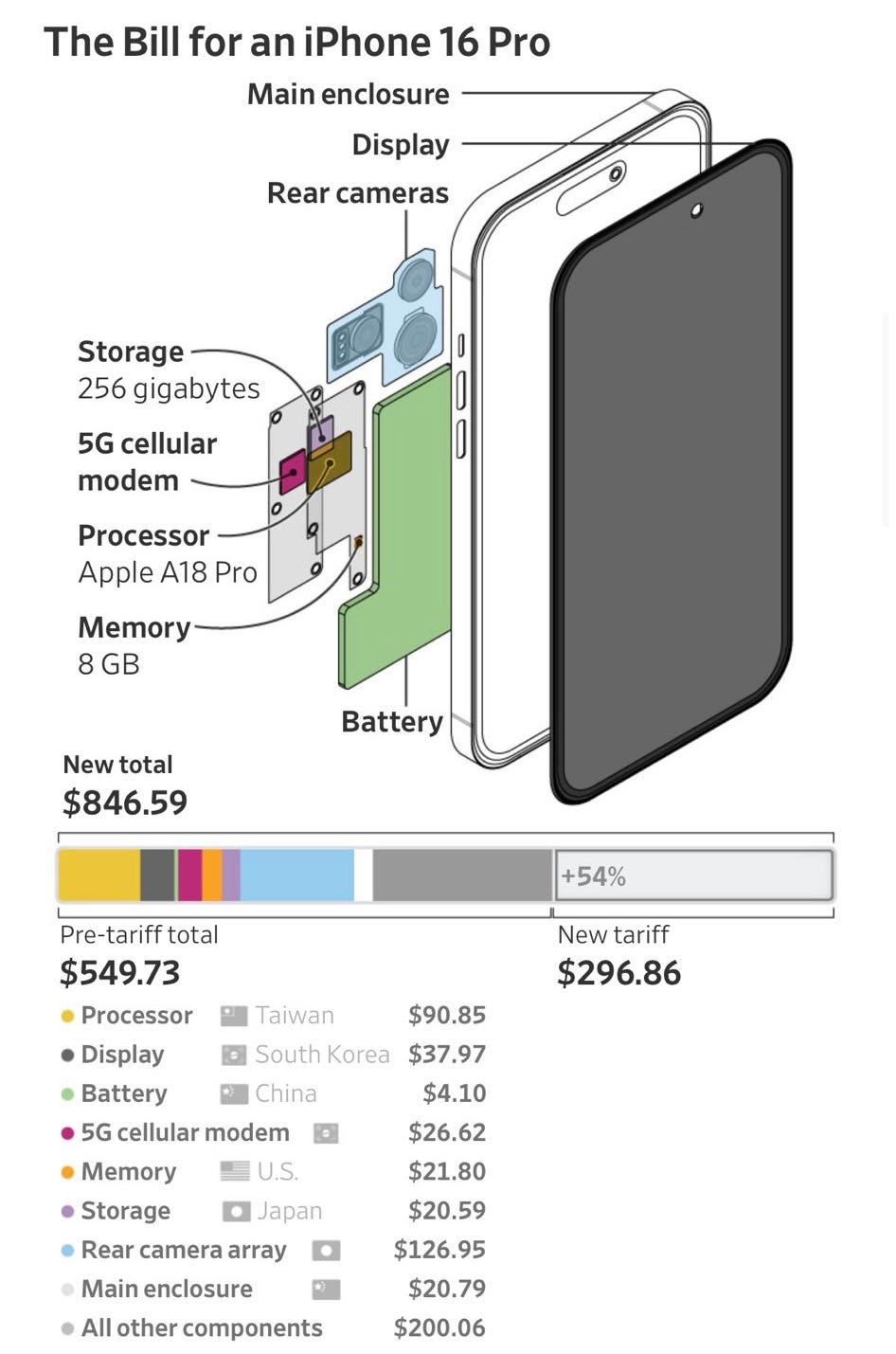

With Trump's recent tariff announcements, my shipments from China will now be subject to a total tariff rate up to 54% upon arrival in the U.S. That's a tax equal to 54% of the value of goods imported from China.

To put this in concrete terms: a stainless steel item that costs me $15 to purchase from my Shanghai supplier will now incur an additional $8.10 in tariffs ($15 × 54%). This doesn’t include the additional paperwork, customs broker fees, and other administrative costs that come with formal entry procedures (since the de minimis exemption will no longer apply).

I'll have to decide whether to eat these costs and reduce my profit margin, pass them on to my customers and risk lost sales, or a combination of the two.

Meanwhile, as countries implement retaliatory tariffs against US exports, my international customers will face higher customs duties and fees when ordering from my U.S.-based business, further complicating my global sales strategy.

3. Why not just produce your products in the U.S.?

I have been developing original furniture products in the U.S., and it's taken me all of three years (while working on this full-time) to get to a point where I have a final design and manufacturing partners.

Simply finding manufacturers willing to work with a small brand is a massive hurdle. I've contacted thousands of U.S. manufacturers, and most wouldn't return my calls or emails because my order quantities weren't large enough, or I didn’t have enough established credibility.

Once you do secure a partner, domestic manufacturing requires significant upfront investment, longer development timelines, and higher production costs.

Not to mention, even U.S. manufacturers often source raw materials, components, and hardware internationally. The global supply chain is deeply interconnected, and these new tariffs affect American manufacturers too.

While "made in America" is the goal many of us share, the infrastructure and ecosystem for small-scale manufacturing of certain products has largely disappeared from the U.S. Rebuilding it will take time, investment, and thoughtful policy approaches that consider the realities of small businesses—not just sweeping tariffs that threaten to put us out of business before we have a chance to adapt.

how have the new tariff policies affected you, and how might they in the future? are you curious, fearful, confused, excited? i’d love to hear your take.

Jamie ... great piece, clear and to the point. I will send you Paul Krugman's substack piece on trade wars and tariff's. Your article boils his larger piece down to a very specific and relatable example. Keep it up!

Thank you Jamie. It's not that more US manufacturing is not a valuable goal, but that it takes a thoughtful process, not a sledgehammer. This is an important conversation. Good luck -- I love what you do.